The PIRAMIS payroll program manages the full range of labour and payroll accounting tasks of the employees.

The PIRAMIS payroll program manages the full range of labour and payroll accounting tasks of the employees.

In terms of the form of the contractual relationship, payroll accounting can be provided for:

-

Work and assignment contracts

-

EKHO (simplified contribution to public revenues) legal relationships

-

For legal relations within the framework of simplified employment

-

Students’ contractual relationship

In terms of wage’s form, accounting as monthly wage, hourly wage and performance wage is provided.

It is possible to initiate the printing of the employee contracts, contract modifications, job descriptions, notifications of wage changes in various formats defined by the user.

Payroll

The payroll accounting automatically calculates the incomes determined by the statutory regulations and their public charges based on the monthly attendance sheet. The software handles the accounting of complicated wage withholding, calculates interests, and manages several wage withholdings simultaneously. The wage difference resulting from working time adjustments is automatically determined and accounted during the regular monthly payroll accounting.

The payroll accounting handles the mid-month wage increase, either for a retrospective period or for the previous year, by dividing the legal titles for the correction period into correction year and month. It is possible to carry out payroll accounting in a foreign exchange, for which a foreign exchange folder can be made. During payroll accounting in a foreign currency, for the payment given in any foreign currency, the income can be accounted in forint in accordance with the law.

Within the framework of legal compliance, the work wage is accounted in accordance with the supported provisions of the Labour Code of 2012 before or after the modification: calculation of monthly salary, determination of wage supplements, calculation of average salary or absence fee.

The income accounting or the preparation of the deduction details for the processing necessary for the payroll accounting may take place during the month; the legal titles to be accounted can be loaded into the account preparation function from the excel table or can be recorded manually.

During one month, an unlimited number of mid-month non-regular payments can be made. The accounting option of the social security benefits is provided within 8 days.

The legal title code repository of the Payroll Software is accessible and can be maintained by the user. Accounting per worker and group accounting can also be performed.

Free format – listing options with content of freely adjustable parameters

With a combination of contractual data, wage data, working time and staff (headcount) data. Working time and headcount reports connected to payroll calculation can be made. The accounting of the reimbursement of commuting (road-rail) is also provided, which takes into account whether the employer or the employee purchases the tickets and travel cards.

The accounting of membership fee contributions to voluntary pension funds by the employer and the employee is supported, along with the automatic accounting of CAFE cards, Insurers, membership of Private Pension Funds. The legal titles necessary for the legal compliance of the legal title code repository are maintained by centralized automatic production.

Following the accounting, the check and control lists and statements that meet the practical requirements can be made with multiple listing functions and technologies, and can be exported into the excel according to the practical requirements. The corporate payroll aggregator also supports the production of management reports using PIVOT (diagram viewer) technology.

The wage slip can be created with multiple content and printing forms. The production of the wage slip can be done by machine which envelopes it with the list of payments. The wage slip is also available to the employee: it is sent as an encrypted file via e-mail or the employee can download it from the WEB Self-Service Portal.

Records of data defined by the payroll accountant

In addition to the contractual and administrative data of the employees, there is the option to record and retrieve the data which can be freely defined and expanded by the user in the software. In the system, the payroll accountant can create an unlimited number of attributes and attribute groups – describing the worker – next to which any number of additional attributes and the connected code repository can be defined (for example, informative data can be recorded here: data on the employees’ leisure activities, plus allowances that do not entail accounting obligations etc.).

Tax allowances for social contributions

Benefits accounted based on a certificate

- Benefit of job seekers registered for at least 3 months

- Regular job support (public employment)

- Benefit of part-time employment

- Benefit for rehabilitation card

- Benefit of self-employed persons with changed ability to work

- Benefit of career starters under 25 years of age

- Benefit of permanent job seekers

- Employment benefits for child care allowance, child care fee, child-raising allowance

- Employment benefits of employees in the free enterprise zone

- Benefit of researchers

- Benefit of researchers (PhD training)

- Benefits for child care allowance, child care fee, child-raising allowance in the case of three children

AUTOMATICALLY GIVEN

- The benefit of persons not requiring vocational training should be enforced, if the conditions exist

- The benefit as per the age should be enforced, if the conditions exist

- The benefit of employees in agricultural jobs should be enforced, if the conditions exist

The administrator does not have to decide which benefits can be used for the employee, because the payroll software calculates all the benefits that can be given, but applies only the most favourable one. The validated social benefits can be shown on the e.g. corporate payroll summary per legal title.

Creating a wage slip

- In 24 different print formats with different data content, the wage slip can be customized to your business

- The data displayed in the header can be controlled

- Multiple different wage slip display modes can be used per legal entity

- The possibility of sending the wage slip to a group by e-mail – the developments made by our company support the paperless office, as far as possible. If the company’s internal policies permit, the wage slip may be sent by an encrypted email to the e-mail address provided by employees. The opening of the message is only possible after the password is entered. These emails can easily be generated and sent as encrypted file attachments to the user-selectable employee groups with a few clicks.

- The files created prior to posting can be archived according to the users’ needs.

- In our web-based Self-Service HR solution, the employees can view their wage slips and print it, if they wish, so the printing of the wage slips can be avoided.

Loading data from other systems

Supported options: loading of e.g. individual work schedule, working time, payroll, performance percent data from other systems of the company e.g. production control, performance measurement, access control data, loading of assignment plans, loading of attendance data.

DATA LOADING OPTIONS

The PIRAMIS™ software supports the loading of data from external systems (wage change data, working time data, individual work schedules, payroll data, contract modifications, voluntary fund data, non-accounted primary producer’s data for the 08 return, performance percentages, data entry from access control systems).

Managing the work schedules

According to the Labour Code, the employer is obliged to determine the work schedule of the employees when the employment relationship is established. In the PIRAMIS™ software, weekly, monthly, annual, and individual work schedules can be created. By assigning the work schedule to the work contract, it serves as a starting point for the working time records.

In accordance with the definition of the working schedule, the system automatically determines the shift allowances and entitlements as per the Labour Code based on the start and the end of the working time. It is possible to automatically create break/ rest periods as per the Labour Code, or to use different breaks depending on whether the break is paid or unpaid. When an access control system is used, the software compares the data received from the access control system to the working time specified in the work schedule. The IN-OUT motion data arriving from the access control system can be displayed as a control when the working time is recorded or the group assignment is recorded.

Working time analytics and headcount calculations

In the PIRAMIS ™ payroll software, the working hours worked and the absence data can only be specified in a daily breakdown. In addition, it is possible to specify certain working time data in the system at a monthly level.

The daily working time record can be broken down even with minute accuracy in the code-level analytics: organization, cost center, operating code, job number, workflow, and organizational hierarchy which differ from the default data specified at contract level. The number and level of the analytical levels below the organization and cost center levels can be determined by the company.

The analytical payroll division methods at working time level may be different:

– Percentage (%) analytics per worker

– Hourly analytics per employee

In the PIRAMIS™ wage program, the legal, statistical, opening, closing, and average headcount figures can be determined and stored in a daily breakdown, as specified by law, and, as a result, several reports support their control statement.

Payroll accounting using working time frame

The Labour Code provides an opportunity for the employer to apply working time frame that is more adapted to the changing market demands and differs from the monthly working time assignment, for a certain period of time.

The working time balance statement can be viewed and queried. The working time periods can be freely defined in the system: they may either begin in the middle of a month, or brought over from the previous year.

In the meantime, the worker can be moved from one type of working time frame to another. Based on the working time data recorded in the system, the working time balance statement can be queried for any period in the current year. The discrepancies at the end of the working time period can be settled, on demand, by giving this information to the payroll accounting.

Analytical storage of payroll data

In the PIRAMIS™ wage program, the analytics of the accounted wage data is already mapped at working time level, thus providing the analytical wage division.

The sending of the payroll data to the analytical ledger is thus ensured. In the ledger, only the accounting rule should be entered, and, based on that, the system automatically sends the payroll data to the analysis.

The analytical breakdown of the working time and wage data also provides important detailed information for the post-calculation.

Accounting the social security benefits:

The PIRAMIS™ program automatically performs the correction of the working time data and validates it in the payroll accounting based on the recording of the medical certificates. The basis of the benefits is collected from the 08 return according to the legal regulations. The settlement of the benefits and the creation of the data sheet are automatically made from the calculated accounting period.

Analytical data services:

“drilling” technology

Regarding the aggregated data collected for each column of the PIRAMIS™ data service, the software can show how the amount of the given item was collected from accounted legal titles and employee data.

Managing the wage withholdings

The PIRAMIS™ software manages the wage withholdings to help the administrators. The managing the wage withholdings provides a solution for the easy recording and handling of cases, as per the daily practice, and for the automatic calculation of the interest rate for commission calculations per grade.

Managing payroll accounting corrections

Managing the retrospective adjustments to the working time and payroll data are fully supported by the PIRAMISTM Payroll Program.

These corrections may come from retrospective wage increases, from the correction of working time data.

In the system, in addition to the original state, all the correction figures are retained and the data of both states can be retrieved retrospectively.

Automatic mapping of the differential items based on the correction.

Payroll accounting in foreign currency and folder

In the case of work abroad (posting), the determination of the statutory tax-exempt and taxable portion of the daily subsistence allowance – even in multiple foreign currencies – paid for the posting.

Accounting the personal income tax advance and contributions, managing the foreign exchange folder, daily allowances accounted in foreign currency – with the deviations from the rounding due to the conversions – and sending it to the ledger.

Monthly wage denominated in foreign currency:

In the employment contract, the classification wage can be determined in foreign currency, which can be accounted as follows: at the foreign exchange rate valid on the day of payment or at the daily rate given by the user.

Automatic contract modification in the PIRAMIS ™

- for retrospective pay raise

- when bulk cost center change is loaded in the excel worksheet

- when work schedule or job scope changes are loaded in the excel sheet

Export option

In the PIRAMIS ™ payroll software, using the technology, the user can set the data columns according to their needs.

With just a few clicks, you can aggregate and group, then export the data shown on the screen into various file formats (xls, pdf, etc.).

Managing borrowed workforce

The PIRAMIS ™ system allows the registration of the employees borrowed from temporary work agencies.

The administrative and other descriptive data of the borrowed employee can be recorded and maintained, complemented by the data freely adjustable and expandable by the user. The working hours (attendance hours) of the hired labour force can also be recorded and TMUNK data provision can also be made.

Managing legal succession

In the knowledge of the predecessor company’s name and the date of succession from the company, the payroll software manages the data of the previous legal entity and the new legal entity within the framework of the T1041 data supply.

The administrative and other descriptive data of the borrowed employee can be recorded and maintained, complemented by the data freely adjustable and expandable by the user. The working hours (attendance hours) of the hired labour force can also be recorded and TMUNK data provision can also be made.

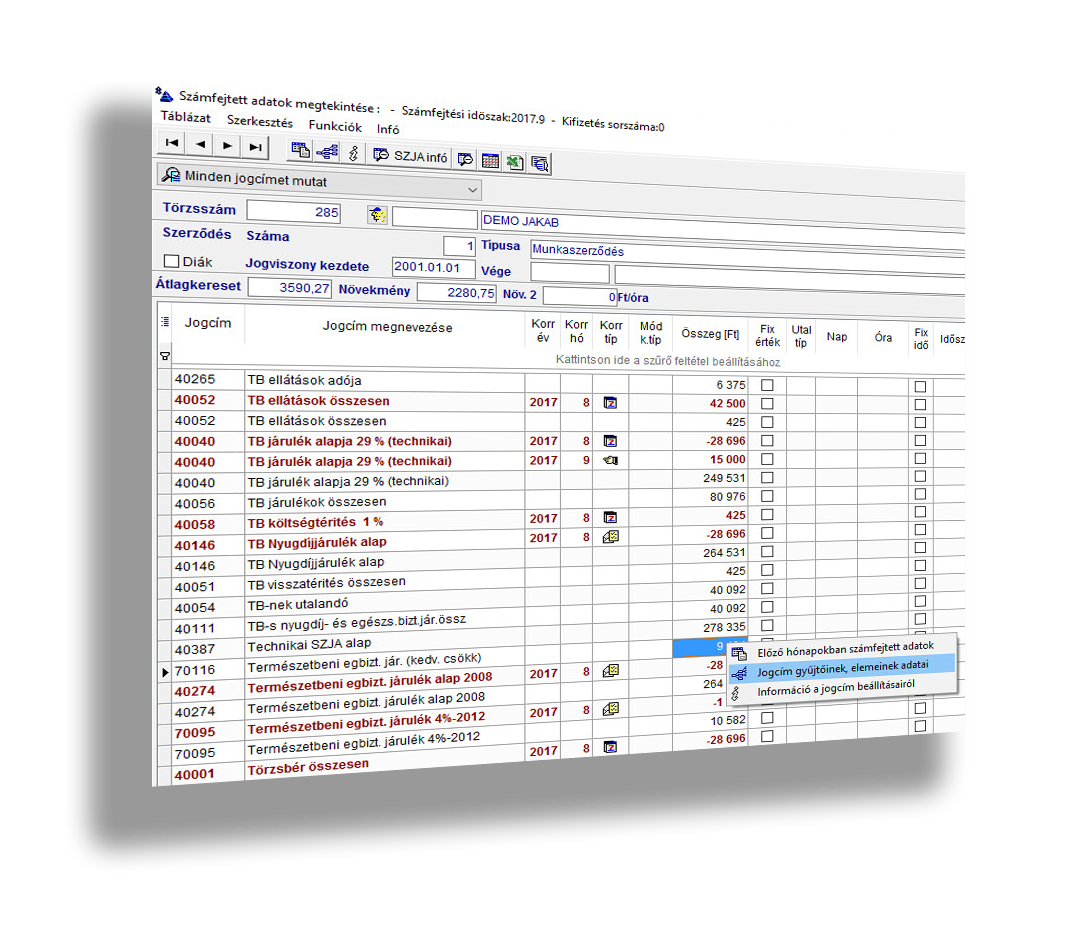

Immediate information on the aggregated data (payroll legal titles) during payroll accounting: with a right-click on the aggregate data, the payroll accountant can view:

- the figures accounted in the previous month

- what subtotals the aggregate data contains

- and see the settings of the legal title

Retrospective change in wages –the wage increase for the previous months has an effect on the base wage, the supplements, the supplemental wages and the sick leave. In the PIRAMIS™ payroll program, the wage change can be done retrospectively in % or in a fixed amount per employee, or any employee group (either sorted by cost center, organization, etc.).

After calculating the wage change, the PIRAMIS™ automatically generates a contract modification for the employee, with the new classification salary or variable salary.

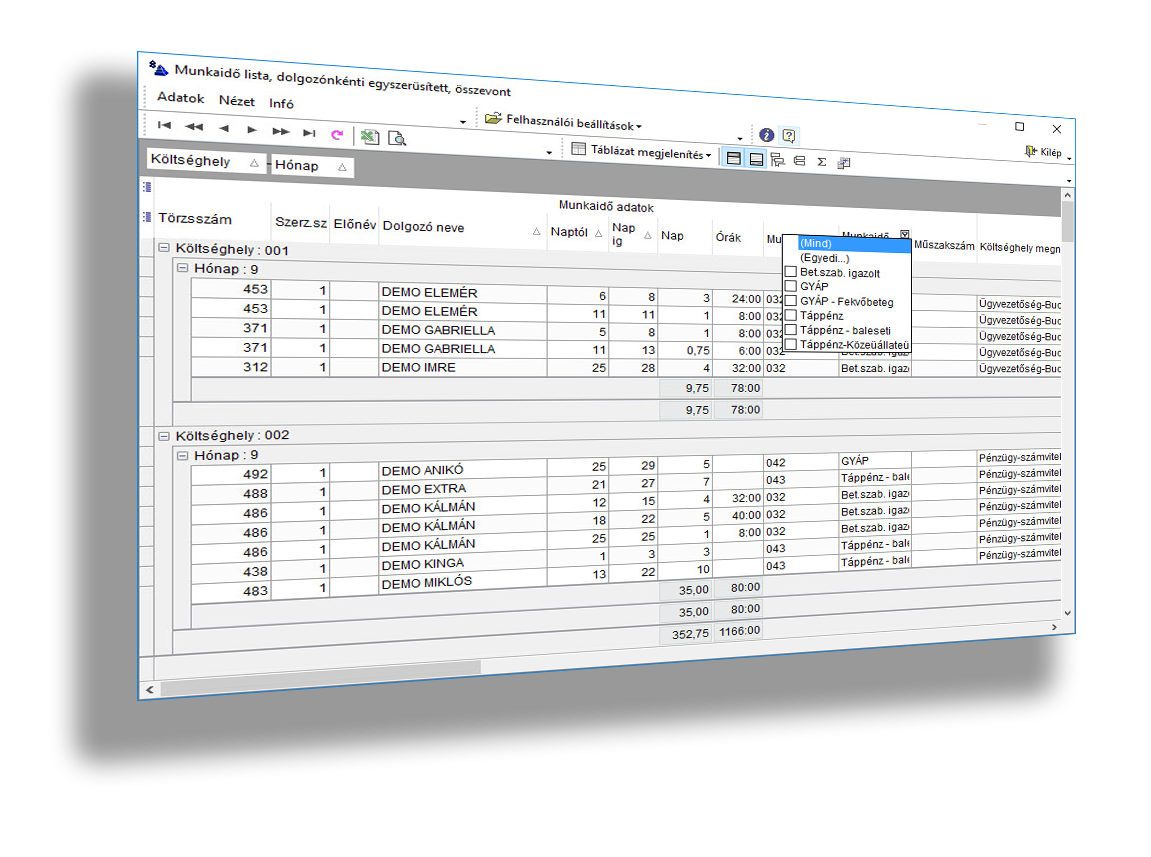

Working time display – the list on the picture can be customized according to the user’s needs. Dragging the columns to the gray grouping field, another statement can be created according to the individual request – the summary of the working time data of the employees can be seen in a monthly breakdown. The columns of the table display operate as a filter so the collected data can be further filtered and exported to an Excel worksheet.

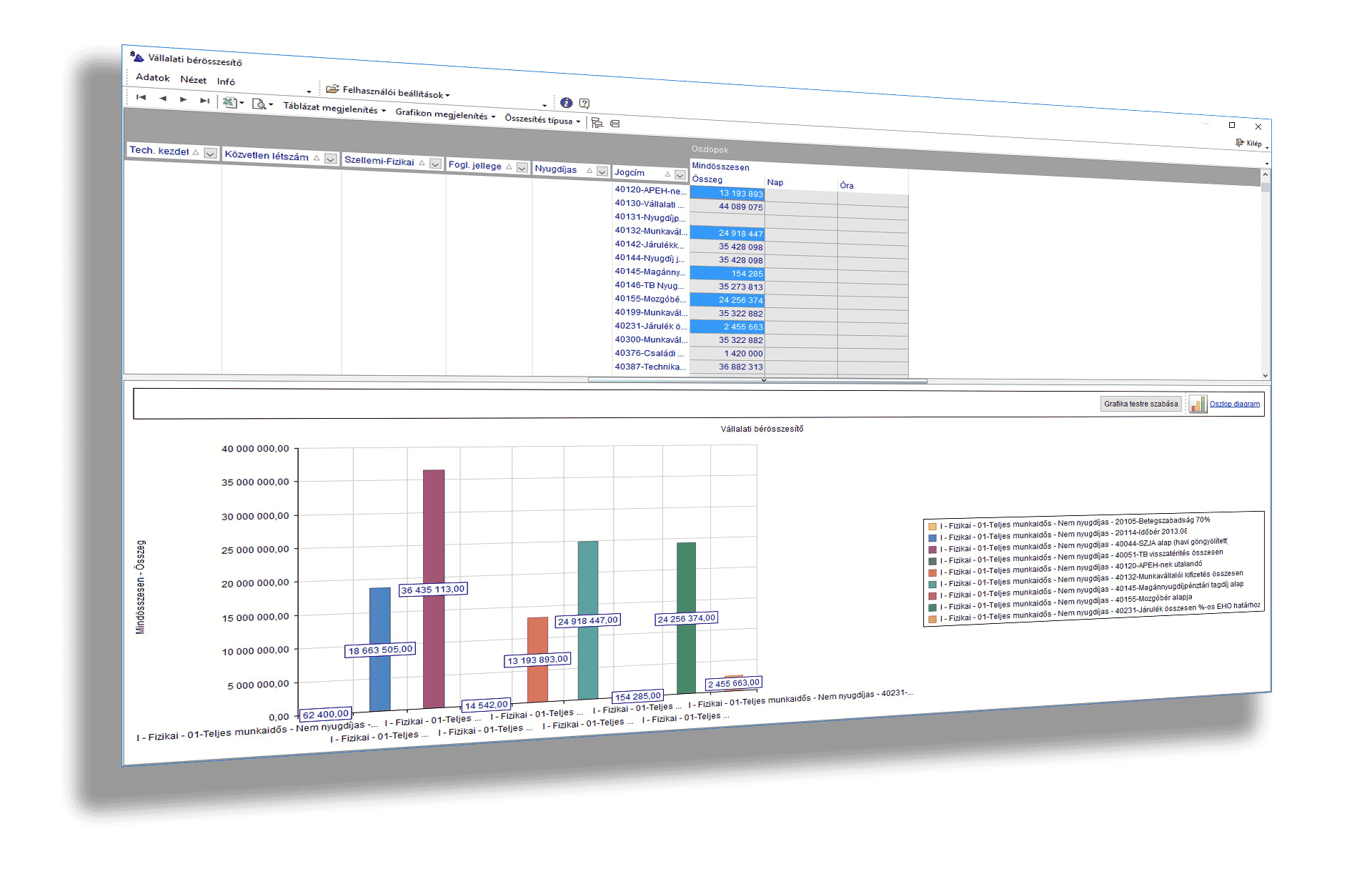

The PIVOT technology supports the corporate payroll statement

The PIVOT table inquiries provide the option to graphically display the collected data, as well.

The data that you want to display on the graph can be selected. From the available legal titles of the corporate payroll summary, the user can select which ones he wants to include in the current report.