Official motor vehicle registration programs.

Official motor vehicle registration program

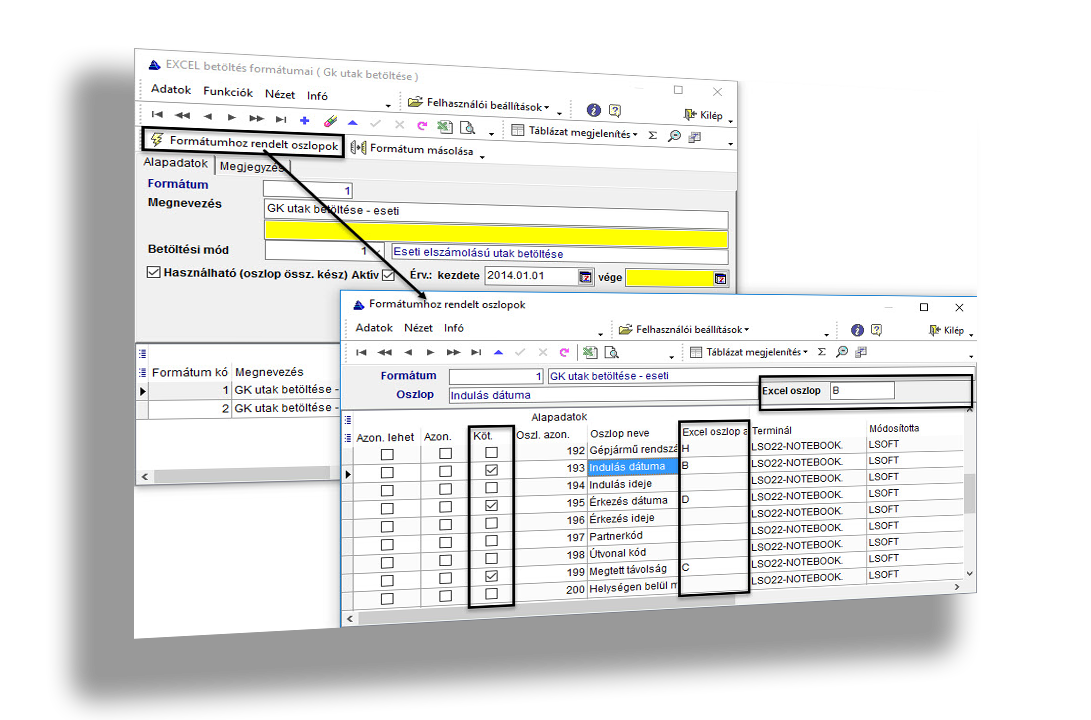

The registration of motor vehicle use and travel expense accounting of the employees included in the wage and employment subsystem, as regulated in the Personal Income Tax Act, with software for companies and corporations

main features

- It ensures the keeping of the journey registration according to the current Personal Income Tax Act.

- If the employer does not only provide the employee with a reimbursement of the amount specified in the law, the taxable part is generated separately from the reimbursed sum

- When calculating the amount to be paid, the pre-paid advance for the journey is already taken into account.

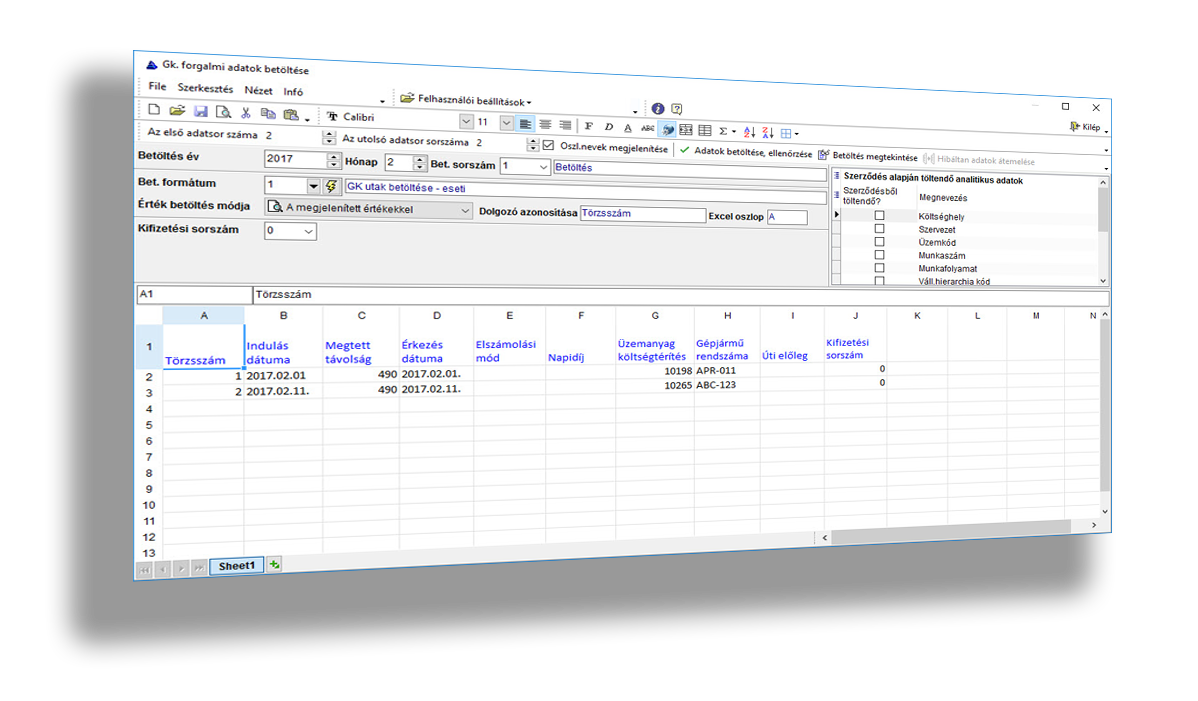

- The data to be accounted will automatically be sent to the payroll accounting.

- It is possible to maintain the fuel types and their daily rates, and to maintain the business partners and the related routes.

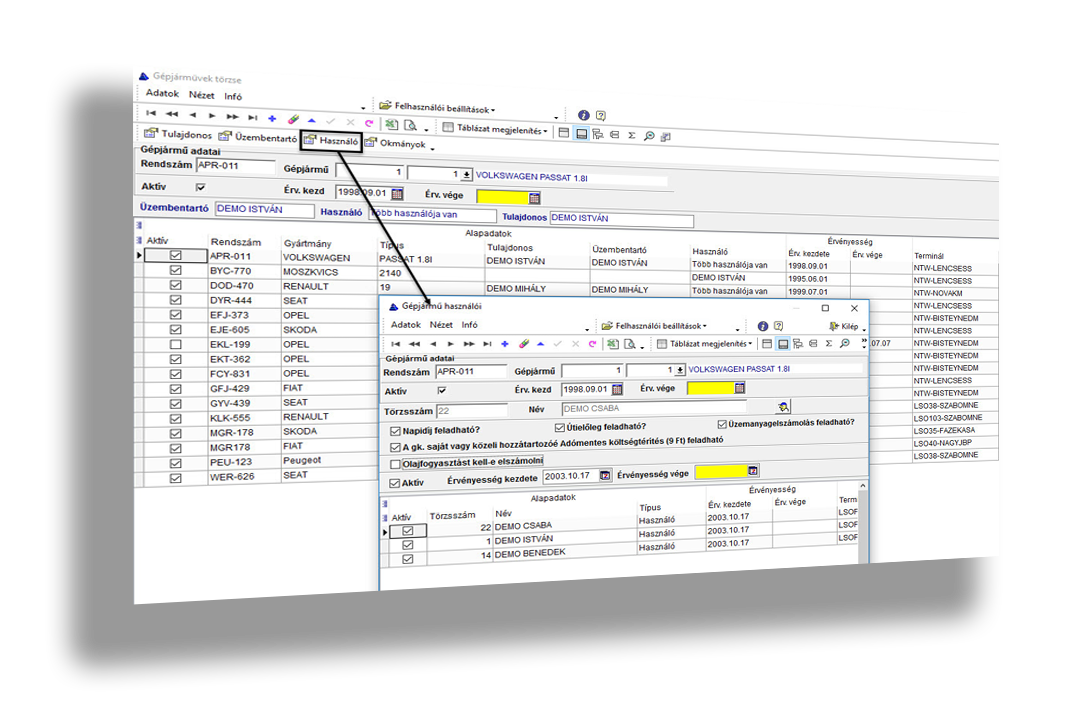

- In the motor vehicle registration module, you can record the data of the employees own vehicles and of the company-owned vehicles they use.

- In addition to commuting, flat-rate and ad hoc accounting is also supported.

- In the case of a changed fuel price, the cost reimbursements can be converted retrospectively.

Registration and maintenance of motor vehicles for official use, determination of the vehicle’s user

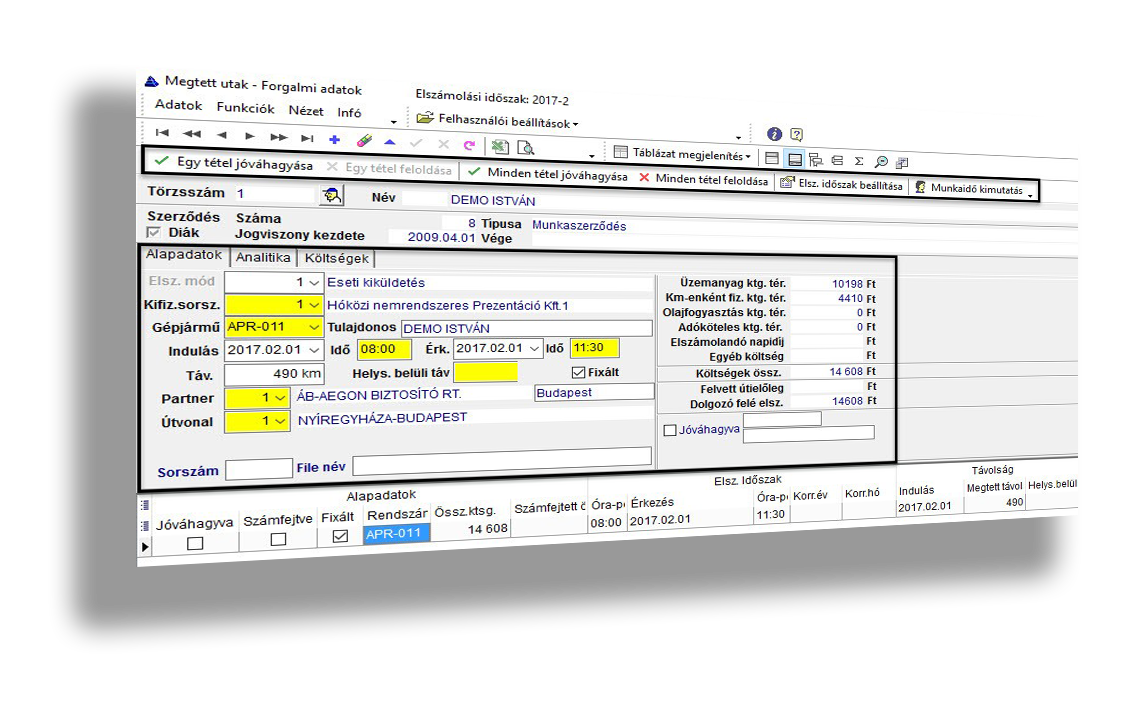

OCCASIONAL POSTINGS

While processing the data of the colleague who uses the vehicle, it can be determined which costs can be registered, sent and accounted for a given license number and person.

e.g.

- the car is the property of the employee or a close relative (e.g. wife, husband);

- the daily allowance and

- the travel cost advance,

- whether the fuel consumption should be accounted

Based on the travelled distance, the vehicle registration program calculates for the ad hoc posting of the employee:

- the fuel cost reimbursement

- the daily allowance to be accounted

- other costs

- and it can be seen if the employee has received travel cost advance